Financial Services Review: Specials Magazine

For decades, financial professionals have been learning to speak the language of machines and adapting their workflows, queries and thinking to match software demands. That era is ending. The next wave of financial intelligence, led by FactSet, aims to meet professionals where they are, interpreting intent, understanding natural language and surfacing insights proactively. As a long-time financial data and analytics provider, FactSet has spent years laying the groundwork for this transition. Its open, flexible platform consolidates data from hundreds of disparate sources, powering faster, deeper and more forward-looking decisions across the financial spectrum. “Our evolution goes beyond productivity. It’s about reclaiming cognitive space, freeing professionals to focus on decision making and revenue generation, not navigating complex tools,” says Kate Stepp, CTO. By integrating machine learning and AI since 2007 and large language models (LLM) as early as 2018, FactSet demonstrated how financial professionals can work, enabling them to focus on deal-making and revenue generation, rather than navigating software. Clients can query high-quality structured and unstructured data, automate time-consuming tasks for pitchbook creation, produce portfolio commentary and capture key points, themes and sentiment from earnings transcripts, all in one flow. The dynamic nature of AI and generative AI unlocks material efficiencies at scale, reducing what once took hours to minutes. Stepp expands on how this shift transforms user experience and unlocks measurable benefits. Q: How have LLMs changed how users interact with data across FactSet’s platform and what productivity gains are you seeing as a result? LLMs have changed how our users engage with data. Our digital platform holds vast structured and unstructured data, but navigating that depth requires specialized training. You had to know where to click, what to search and how to work with each tool. Now, users simply ask direct questions versus clicking for information. With natural language inputs and GenAI capabilities, they express intent to ‘find the earnings highlights,’ ‘summarize this portfolio’s performance,’ or ‘create custom charts and slides,’ and the system interprets and delivers, often pulling together data in seconds and responding in a more dynamic way that molds to users.

Top Crypto IRA Retirement Platform 2025

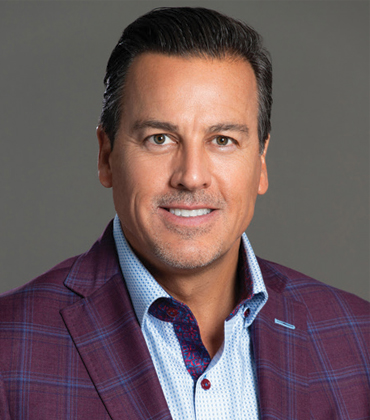

iTrustCapital is redefining how individual investors engage with digital and alternative assets. A fintech platform purpose-built for security, transparency, and ease of use, it enables clients to invest in cryptocurrencies and precious metals through self-directed IRA and non-IRA accounts. iTrustCapital combines institutional-grade infrastructure with personalized service, bridging the gap between advanced financial tools and everyday investor access. iTrustCapital entered the market as digital assets became increasingly mainstream, but remained inaccessible primarily to average investors. Today, the platform has over 250,000 registered users, 75,000 funded accounts, and a transaction volume exceeding $14 billion. It has become a trusted gateway for professionals, retirees, and crypto newcomers, those seeking long-term financial security in a rapidly evolving economy. “We are not just giving investors access to digital assets. We are providing new AI tools and other educational resources, giving them the clarity, peace of mind, and control to help build a more secure financial future,” says Kevin Maloney, CEO of iTrustCapital. Building Trust through Security, Compliance, and Support Central to iTrustCapital’s offering is security. The platform operates on a closed-loop architecture that prevents unauthorized withdrawals, even if a user’s login credentials are compromised. Assets are never loaned, commingled, or exposed to third-party wallets. They are safeguarded in cold storage through regulated custodians like Coinbase Institutional, Fidelity Digital Assets, and Fireblocks. These partners utilize multi-party computation (MPC), eliminating single points of failure and ensuring the highest level of asset protection. Equally foundational is the company’s dedication to regulatory compliance. All transactions are auditable, and assets are held off-balance sheet by U.S. bank-regulated custodians. As a former Compliance Officer at PIMCO, Maloney helps iTrustCapital bring a level of operational rigor often lacking in the digital asset space, particularly valuable for clients less familiar with the nuances of cryptocurrency investing. iTrustCapital also maintains a fully U.S.-based client experience team in Southern California. These trained representatives offer direct, human assistance by phone or email, a rare feature in the fintech industry. The company’s dedication to service has earned it over 9,000 five-star reviews across various platforms, including Google and Trustpilot.

Top Financial Investment Advisor and Planning Service 2025

CPR Investments Inc. is a registered advisory firm with a difference. Challenging the status quo in traditional portfolio construction, it develops adaptive investment strategies using technology to help clients achieve their long-term financial goals. Going beyond static portfolios that are reviewed annually, its dynamic portfolios are updated daily with real-time visibility into an investor’s financial picture. The result is a living, responsive financial plan that evolves and adapts alongside an individual’s investment journey. Whether the objective is to build wealth or plan the next financial goal, CPR Investments Inc. delivers a full suite of investment planning services through a consistent, client-first experience. Supporting this approach is its growing suite of custom investment strategies created with its proprietary financial planning software. “Our ability to rapidly adopt new technology and offer investment advice helps clients understand current investments and achieve their financial goals on their desired timeline,” says Charles P Reinhold, president and CCO. Its advisors use tactical and strategic money management, options and futures to design non-traditional portfolios that help clients meet their investment objectives. The engine behind CPR Investments Inc.’s capabilities is its software, which provides an all-encompassing view into clients’ entire investment picture. Online financial planning tools link a client’s investment accounts, enabling advisors to conduct detailed portfolio analyses, propose effective investment strategies and build dynamic financial plans. Investors can log in at any time to monitor the progress of their plans and ensure they’re on track with their goals. Sophisticated portfolios curated by CPR Investments Inc. make advanced financial planning accessible to a wide range of investors. A prime example is its Apex portfolio, which brings the services of tactical money managers who implement advanced investment strategies for high-value portfolios. The firm’s innovative trading infrastructure pools individual accounts together to create a single high-value portfolio, which can be handled by third-party money managers. This approach helps deliver portfolio management to clients across wealth levels in a scalable, efficient way.

Debt Collection Service of the Year 2025

Long-term financial health hinges on strategic, compliant revenue recovery. For over 50 years, Collection Bureau Hudson Valley (CBHV) has been maximizing the recovery for enterprises through compliant, customer-sensitive engagement. Its approach safeguards brand integrity and preserves the potential for future customer relationships. CBHV’s expertise as a collection agency is instrumental in driving success for a diverse clientele spanning finance, education, healthcare and communication. With over 200 years of combined industry experience, its management team brings deep understanding of client and consumer expectations to every engagement. “We have an open and honest approach to all aspects of our business,” says Eric S. Najork, president. “This has made us a valued and profitable partner in account receivables.” An effective digital collection strategy is the hallmark of CBHV. It leverages advanced technology to streamline workflows, ensure regulatory compliance and enhance collector productivity without forgetting the value of the human touch. The team communicates with consumers in whatever way is most convenient—text, email, phone or letter—and offers diverse payment methods. The tech infrastructure, paired with experts, supports collection programs that can scale swiftly to meet evolving client needs.

Top Wealth Management Services 2025

Business owners are entering a critical stage where succession decisions can no longer wait. Retirees are stepping into the next phase of life, seeking clarity around long-term planning and financial stability. Women, who are expected to manage an increasing share of wealth, continue to look for financial spaces where they can learn, ask questions, and plan with confidence. These are real transitions, and the demand for thoughtful, personalized support is only growing. TrustPoint brings that to the table. Every engagement is driven by a team-based model, where experienced professionals collaborate to deliver thoughtful, customized solutions. Fiduciary in structure and client-first in practice, the firm remains free from commissions and product affiliations. Its purpose is to simplify wealth, support transitions, and earn the confidence of those it serves at every stage and for every need. “We’ve been in business for over a century, and that reflects a long-term investment in our team, our community, and, most importantly, our clients,” says Bill Bosch, CEO. TrustPoint’s mission centers on preparation, because the most important financial outcomes are shaped well before the actual moment of transition. For business owners considering succession, early conversations can make the difference between a smooth transfer of leadership and a rushed exit that diminishes value. Advance planning opens the door to strategies that reduce tax exposure, address family dynamics, and ensure that the proceeds of a sale support both personal and philanthropic goals. The same principle applies to individuals approaching retirement, where careful life planning transforms decades of saving into sustainable income, creates tax advantages, and provides flexibility to pursue long-held aspirations. That commitment also extends into initiatives designed for specific groups and future generations. Her Point, TrustPoint’s women-focused program, recognizes that women often approach financial decisions differently, from how they save to how they invest for their families. Through education, shared experiences, and a supportive community, it builds both knowledge and confidence at a time when women are positioned to inherit and manage unprecedented levels of wealth. The same emphasis on education is reflected in the firm’s partnership with the Boys and Girls Club of Greater La Crosse. By introducing middle and high school students to financial concepts like saving, investing, and economic awareness, the program creates a foundation for healthier financial choices in adulthood.

Top Accounts Receivable Management Service 2025

The checklist for maintaining an in-house accounts receivable is a long one. Specialized staff, advanced communication systems, regulatory compliance and constant technological upgrades — all of them play critical roles in the collection process. For many businesses, building this kind of infrastructure internally is simply too expensive and drains resources that can be allocated toward core operations. For over 20 years, Southwest Recovery Services has filled that gap, stepping in to help businesses collect more, faster. The company works with industries across the board, from banking, finance and utility to construction and oil and gas. Its revenue cycle outsourcing solutions boost collection rates, accelerate cash flow, and cut operational costs — all without putting customer relationships at risk. Southwest achieves this by acting as an extension of the client’s brand. Rather than taking a one-size-fits-all approach, the company listens first, engaging in a detailed discovery and setup phase. It pays close attention and understands each client’s internal processes, communication preferences, and strategic goals before designing a solution tailored to their specific challenges. That could mean deploying a first-party outreach team to act as a polite reminder service or acting as a full-scale recovery partner operating under the client’s name. “Regardless of the means of recovery, our focus is always on preserving goodwill and representing the client professionally,” says Steven Dietz, CEO. “We train our staff to treat every customer with the utmost respect—speaking to them as they themselves would want to be spoken to if the roles were reversed.”

Top Business Loans Service 2025

The order book was full, the season was peaking, and a seafood business had a golden opportunity to move millions of dollars in lobster each month. There was only one problem: their bank could not provide the capital needed to seize it. Waiting weeks for approval wasn’t an option, as it would lead to missed sales and lost momentum. That is when Noble Funding stepped in. Within days, the business arranged a facility that combined a receivables-based line of credit with a term loan, unlocking the working capital required to keep shipments flowing and profits climbing. The company has been creating these kinds of timely solutions for two decades, serving as one of the nation’s most trusted providers of large working capital business loans since 2005. It works with growing companies across various industries, offering a mix of speed, flexibility, and integrity that has earned it an A+ rating from the Better Business Bureau, with zero complaints and over 200 positive Trustpilot reviews. “We treat every business like it’s our own,” says Matthew Cohen, president. “That’s because we are business owners ourselves. We understand the urgency, the risk, and the opportunity behind every funding request.” Capital Solutions for Ambitious Companies Noble Funding focuses on businesses with annual revenues between five million and one hundred fifty million dollars. Many already have a senior secured lender, like a bank, SBA lender, or asset-based lender. Often, these relationships work well until the business’s borrowing base no longer matches its growth ambitions. That is where the company steps in with senior debt through lines of credit secured by receivables and inventory, junior debt in the form of unsecured term loans, bridge loans, and expansion capital, as well as unitranche loans that combine both senior and junior debt into one streamlined facility. It also helps restructure existing senior debt and offers SBA loans when appropriate. Loan sizes typically range from three hundred thousand to five million dollars, with the ability to fund in days or weeks rather than months. This speed is possible because Noble Funding works within a carefully curated network of top-tier lenders developed over twenty years. Instead of sending clients through a long shopping process, the company pinpoints the right match quickly, ensuring that terms are competitive and that the process is smooth from start to finish.

Top Debt Collection Service 2025

Since 1996, Advanced Recovery Systems (ARS) has been helping businesses recover what they are owed efficiently, professionally, and with integrity. As a specialized commercial collection agency, ARS provides tailored business-to-business debt recovery solutions across industries, including commercial collections, medical receivables, and air and ground transport billing. With a client-first approach and a dedicated team of experienced professionals, ARS supports a broad client base, including small businesses, major financial institutions, and ambulance service providers ensuring every recovery effort is strategic, compliant, and results-driven. “True success comes from partnership. We believe in working alongside our clients and their customers to create solutions that serve everyone with integrity,” says Numen Bilal, president of Advanced Recovery Systems. Its client onboarding process is quick and seamless. The ARS team connects directly with clients to understand their collection needs and, if aligned, can initiate services within 24 hours. While paperwork and contracts typically take about a week to finalize, the emphasis is on transparency, responsiveness, and a smooth client experience. ARS’s Hands-On Approach to Recovery On the commercial side, ARS manages everything from one-off accounts to high-volume portfolios, with particular expertise in heavy equipment and office equipment financing. The company handles a broad range of balances, from desktop copiers and medical equipment to large construction machinery, including complex six-figure cases. For medical collections, ARS works exclusively with ambulance and insurance companies, assisting with insurance billing, compliance issues, and, when needed, direct patient outreach. “Our hands-on, personalized approach ensures efficient, professional results in complex commercial and medical collections, specializing in heavy equipment financing and ambulance billing,” says, Daniel Spaziani, vice president of ARS.

CXO INSIGHTS

The First of Many Lessons from FTX

Blue Macellari, Head of Digital Assets Strategy - Global Trading, T. Rowe Price

4 Commonly Used Wealth Transfer Strategies

Jeanne Krigbaum, Chief Wealth Planning Officer, Old National Bank

Dealing With Global Tax Compliance

Sergio Vazquez, Transfer Pricing Director, CEMEX

Recent challenges in the industry and how Internal Audit can help

Jacqueline Breslauer, Executive Vice President - Chief Audit Executive, Valley Bank

Latest Trends in Investment Management

Darrell Van Amen, Executive Vice President & Chief Investment Officer, HomeStreet Bank

Why Isn't Tax Season More Of A Team Effort?

Ryan Halleran, SVP, Director of Wealth Planning, D.A. Davidson Companies

Effective Financial Risk Management

Gilbert Asamoah, Credit Risk Manager, NiSource

Driving Marketing Success Through Agile Thinking and Data-Driven Strategy

James Wallace, Marketing Director, Service First Mortgage

Navigating the Evolution of ERP: Business Objectives, Research Extensions, and Digital Debt Management

Alfred Zhu, VP of Digital Technologies, The Middleby Corporation

Crafting the Future of Tax-Efficient Investing

Jeremy Milleson, Director, Investment Strategy, Parametric

Evolving Bespoke Software Through Automation And Ai

David Robertson, Director of Enterprise Architecture, Exeter Finance

IN FOCUS

Digital Strategies Reshape the Future of Debt Collection

Debt collection is evolving with digital tools, predictive analytics, and ethical practices to improve recovery. Innovations like self-service portals, AI, and financial wellness programs enhance efficiency and debtor engagement.

Transforming Financial Services with Artificial Intelligence Analytics

AI is transforming financial services by enhancing efficiency, automating tasks, improving risk management, and personalizing services, while also posing challenges in integration, transparency, and cybersecurity that require careful regulation.

EDITORIAL

Tapping into the Boundless Potential of Finance in 2025

In 2025, the U.S. financial services industry is moving faster than ever, and it’s changing in ways most people don’t notice at first glance. Artificial intelligence is quietly reshaping how decisions are made, helping firms see patterns, spot opportunities, and act with confidence in a world that often feels unpredictable. Technology sets the pace, but it’s the people behind the numbers who turn insights into smart moves.

Even areas that used to feel routine, like debt collection and accounts receivable management, are being reinvented. Automation is speeding up processes, but the real difference comes from putting customers first. Firms that balance efficiency with trust and compliance are gaining an edge, proving that careful management can be as transformative as innovation.

Investment leadership, financial planning, and wealth management are following a similar path. Advisors and lenders are showing that thoughtful guidance can drive growth for both individuals and organizations. At the same time, crypto IRA platforms are opening new doors for a younger, tech-savvy generation, changing the way people think about retirement and long-term planning.

The common thread across the industry is clear. Firms that embrace intelligent systems, responsible management, visionary leadership, and client-driven innovation are shaping the future of financial services. This issue celebrates the leaders, platforms, and solutions that are raising the bar and setting new standards for performance and client success.

Among the standout voices are Paul S. Young, Chief Financial Officer of Liberty Bank and Steven Shafer, Treasury Innovations Team Manager, Bremer Bank. They discuss the challenges and opportunities defining today’s market, the crucial role of technology in shaping outcomes, and their connection to the most transformative changes underway. Their insights offer valuable guidance to decision-makers seeking to thrive in an increasingly data-driven and dynamic financial environment. We believe that they will help you make better business decisions as well.