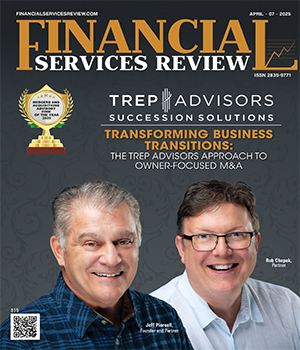

Financial Services Review: Specials Magazine

The world of mergers and acquisitions (M&A) is often seen as a complex and impersonal process, one dominated by corporate jargon, lengthy negotiations, and large institutions. But what if there was a more human-centered way to navigate this challenging journey? Enter TREP Advisors, a firm that is redefining the M&A experience by prioritizing relationships, understanding the unique needs of business owners, and delivering custom solutions that transcend mere financial transactions. In a recent conversation with the team behind TREP Advisors, it became clear that their success isn’t just measured in dollar amounts or the number of transactions completed — it’s in the trust and long-term relationships they’ve built with their clients. With over $150 million in transactions completed in 2024 alone, the firm is proving that theres no substitute for truly understanding the people behind the businesses. Why Choose TREP Advisors? For many business owners, selling their company is one of the most significant decisions they’ll ever make. It’s not just about the money — it’s about the future of their employees, the legacy of their business, and their own personal freedom. This is where TREP Advisors excels. Unlike larger, impersonal M&A firms, TREP Advisors stands out by taking a deeply personalized, ownerfirst approach.

Tax Resolution

Perfect Tax Relief is a trusted tax resolution firm dedicated to providing personalized solutions for individuals and businesses. Specializing in IRS negotiations, debt forgiveness and strategic planning, the firm prioritizes long-term client satisfaction. With a team of experienced specialists, it ensures clear communication and exceptional service throughout the resolution process..

Top Broker Dealers

Britehorn Securities is a committed partner offering regulatory services to investment bankers, M&A advisors, private funds and institutional placement agents. The firm was conceived by experienced investment bankers, Bobbi Babitz Armstrong and Brett Story, with a clear objective to offer a comprehensive brokerdealer solution from the perspective of deal professionals that understand the unique regulatory landscape affecting institutional capital raising and M&A. Britehorn Securities’ founders are practicing investment bankers with unique blend of expertise stemming from time working on Wall Street and practicing corporate, M&A and securities law. This background translates to a broker dealer solution that is specifically tailored to colleagues operating in similar markets. Britehorn Securities is more than a service provider; it’s a dedicated collaborator that renders efficient compliance solutions, swift turnaround times, and unrivaled service. Armstrong, articulates the company’s guiding philosophy, “Our primary objective is to provide our registered representatives with a solid regulatory structure, while giving them the freedom to close meaningful transactions.” Story reaffirms this commitment, “Because we are also investment bankers, we understand deal cycles and where the risks lie in this business so that we can support our representatives from a regulatory standpoint without overwhelming them with unnecessary compliance tasks.”

Top Mergers And Acquisitions Consulting Firm 2025

Expanding a business in the U.S. should be an exciting achievement. However, for many Latin American business owners, the U.S. market presents challenges such as navigating complex financial regulations, understanding valuation processes, and adjusting to new market dynamics. To ensure a successful expansion, businesses must secure expert financial counsel, efficiently structure cross-border transactions, and identify investments with balanced risk. This is where Andrés Remezzano Bongiovani comes in. With over 27 years of experience in financial advisory, he specializes in mergers and acquisitions, business valuation, and wealth management. Having worked extensively in Argentina, Peru, and Mexico, Andrés possesses deep insights into both Latin American and U.S. markets. His ability to connect with Latin American entrepreneurs—speaking their language and understanding their unique challenges—sets him apart from other advisors in the field. He founded Remezzano to help Latin American generational entrepreneurs navigate the complexities of cross-border expansion and family business challenges. The firm provides tailored financial advisory services to support their growth in the U.S. market and beyond. “When I speak with Latin American entrepreneurs in the U.S.—whether they’re first-generation business owners or second-generation investors—I can relate to their challenges in a way that most U.S.-based advisors cannot,” says Andrés.

CXO INSIGHTS

4 Commonly Used Wealth Transfer Strategies

Jeanne Krigbaum, Chief Wealth Planning Officer, Old National Bank

The Importance of Organizational Alignment: Strategy, Environmental Understanding, and Unifying Processes for Success

Michael Dotto, Director, Voya Financial

Latest Trends in Investment Management

Darrell Van Amen, Executive Vice President & Chief Investment Officer, HomeStreet Bank

Lions, Tigers and How to Grin and Bear a PEO Extraction

Ally Lamson, Area Vice President, Equity M&A, Gallagher

The changing role of finance, and FP&A in the modern business environment

Christina Homburg, Global Head of M&A, Marley Spoon

IN FOCUS

The Role And Impact Of Mergers And Acquisitions Advisory Services

Mergers and acquisitions (M&A) are among the most transformative and complex activities in the corporate world.

Addressing Financial Challenges With Expertise

Tax resolution services have emerged as a vital support system for individuals and businesses facing tax-related challenges.

EDITORIAL

The Digital Transformation of M&A Consulting

The mergers and acquisitions (M&A) consulting space is experiencing a dynamic shift, driven by evolving market forces, technological advancements, and a renewed emphasis on strategic alignment. As global M&A activity continues to oscillate between market opportunities and economic headwinds, consulting firms are stepping up their game to help clients navigate complexities, mitigate risks, and achieve sustainable growth.

The integration of advanced analytics, artificial intelligence (AI), and machine learning (ML) tools is revolutionizing the due diligence process. Firms are leveraging predictive analytics to assess deal potential, identify synergies, and pinpoint risks with greater precision. This shift is reducing the time required for evaluations while enhancing accuracy, enabling clients to make more informed decisions.

Additionally, tools like natural language processing (NLP) are being deployed to sift through massive datasets, including legal documents, financial statements, and market reports. The result? A comprehensive view of potential targets or partners that goes beyond traditional evaluation metrics.

With globalization persisting despite geopolitical tensions, crossborder M&A remains a key area of focus. Consulting firms are enhancing their expertise in regulatory compliance, tax optimization, and international market dynamics to support clients navigating complex cross-border deals. M&A consulting is becoming increasingly sector-focused, with firms developing deep expertise in industries such as healthcare, technology, financial services, and renewable energy. For example, in the technology sector, advisors are helping clients address unique challenges like intellectual property (IP) valuation and cybersecurity risk assessment.

The M&A consulting space is evolving to meet the demands of an increasingly complex and competitive market. By leveraging technology, focusing on ESG, and developing industry-specific expertise, consulting firms are positioning themselves as indispensable partners in the deal-making process. As companies seek growth through strategic acquisitions, the role of M&A consultants will only grow in importance, shaping the future of business at a global scale.

In this edition, we have featured TREP Advisors. Unlike larger, impersonal M&A firms, the company stands out by taking a deeply personalized, owner-first approach.